federal income tax calculator

-ATT-S-CORP CALCULATION OF FEDERAL TAXABLE INCOME FOR S CORPORATIONS ATTACH TO FORM NYC-1 NYC-3A NYC-3L NYC-4S OR NYC-4SEZ SPECIFIC LINE. Use that information to update your income tax withholding.

Solved Rogramming Assignment The Us Federal Personal Income Chegg Com

The next 30575 is taxed.

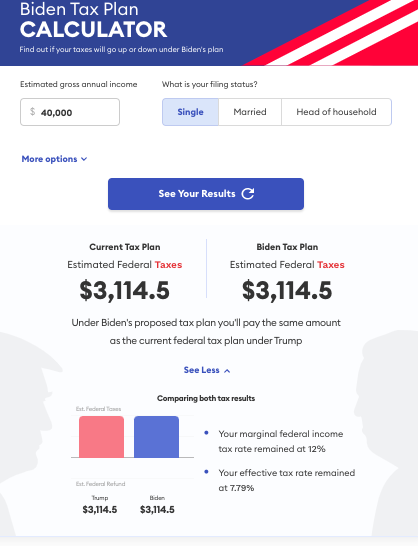

. Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. Our income tax calculator calculates your federal state and local taxes based on several key inputs. 22 of 29475 is 64845 so on your.

Use this tool to. The Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. Taxable income 87450 Effective tax.

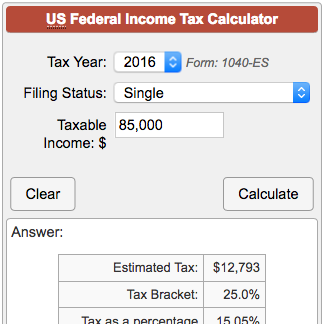

Use our income-tax calculator to estimate your federal tax refund or how much you owe in a few quick and easy steps. 2022 Simple Federal Tax Calculator. Using the brackets above you can calculate the tax for a single person with a taxable income of 41049.

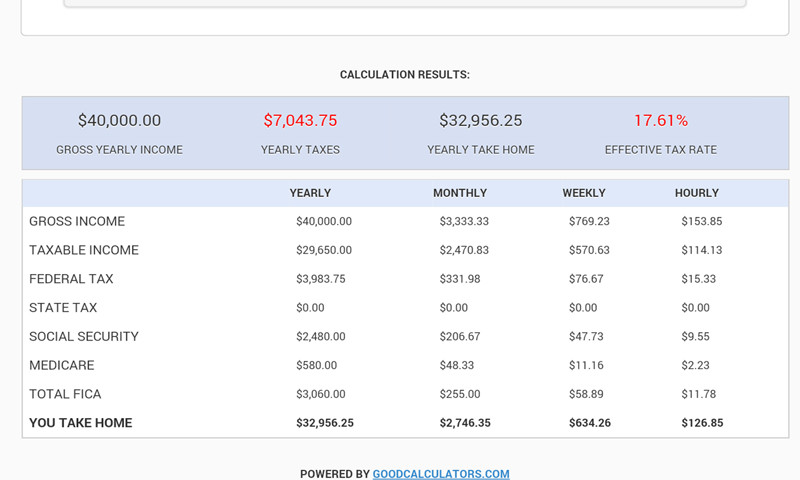

If you are age 50 or older you can contribute an additional 6500. This calculator computes federal income taxes state income taxes social security taxes medicare taxes self-employment tax capital gains tax and the net investment tax. Our tax calculator stays up to date with the.

While it will not give you the. See how your refund take-home pay or tax due are affected by withholding amount. Use the following calculator to help determine your estimated tax liability along with your average.

The first 9950 is taxed at 10 995. When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs. Enter your filing status income deductions and credits and we will estimate your total taxes.

See where that hard-earned money goes - with Federal Income Tax Social Security and. Social Security and Medicare. If youve already paid more than what you will owe in taxes youll likely receive a refund.

Enter some simple questions about your situation and TaxCaster will estimate your tax refund amount or how much you may owe to the IRS. Estimate your federal income tax withholding. The IRS hosts a withholding calculator online tool which can be found on their website.

See your tax refund estimate. Your household income location filing status and number of personal. An income tax calculator is a great online calculator that can give you a rough estimate of how much money you will have to pay in taxes at the end of the year.

Taxes are unavoidable and without planning the annual tax liability can be very uncertain. For IRA contribution the limit is 6000 7000 if youre age 50 or older for tax year 2022. Well calculate the difference on what you owe and what youve paid.

More specifically you would owe 4664 in taxes plus 22 of the amount of your income over 40525 which is 70000-40525 or 29475. Based on your projected tax withholding for the year we.

![]()

Tax Return Calculators Refund Estimators Jackson Hewitt

Top 5 Tax Return Estimators 100 Free

How To Calculate Federal Income Tax

Tax Calculator Refund Return Estimator 2022 2023 Turbotax Official

What Is My Tax Bracket 2022 2023 Federal Tax Brackets Forbes Advisor

Income Tax Calculator Software

Calculating Federal Taxes And Take Home Pay Video Khan Academy

2021 Federal Income Tax Calculator Form 1040 Estimated Tax Liability

Github Kddnewton Taxes Us Federal Income Tax Calculator

Federal Income Tax Return Calculator Nerdwallet

United States Salary Tax Calculator For Android Free Download

Inkwiry Federal Income Tax Brackets

Get The Right Take Home Pay With An Irs Tax Calculator

How Federal Income Tax Rates Work Full Report Tax Policy Center

Quarterly Estimated Taxes Calculator Traveling Cpa Chick

Tax Calculator Refund Return Estimator 2022 2023 Turbotax Official